Hyperledger Bond Trading Platform Goes Open Source

A bond trading platform built on top of Hyperledger's Sawtooth Lake distributed ledger was made open source this week.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/N7APYDESG5BVFERDZAIQ4G6WIM.jpg)

A bond trading platform built on top of Hyperledger's Sawtooth Lake distributed ledger was made open source this week, alongside a release of a demo of the technology.

The project, first announced in September 2016, was designed to demonstrate how bond trading and settlement can be streamlined using distributed ledgers. Created in partnership with the R3 consortium and eight participating banks, the working proof-of-concept has now also been displayed as a public demo on Sawtooth's website.

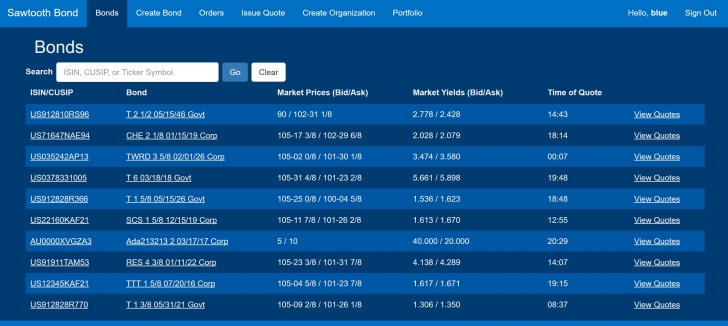

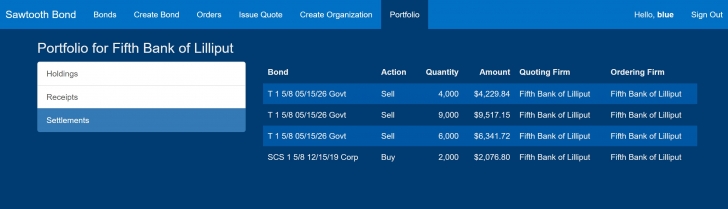

The no-frills platform uses a blockchain to track and categorize transactions including holdings, receipts and settlements.

Also featured is a portfolio-tracking section that lists the name, coupon rate and principal values of bonds held on a user's individual account, and a search allowing users to look up bonds by CUSIP code, yield and price.

The open-source code for the proof of concept is also now listed on GitHub for anyone to use. However, the page states that the platform needs further investment before it can be taken into production.

Trading chart image via Shuttertsock; demo images via Sawtooth/Intel

:format(jpg)/downloads.coindesk.com/arc/failsafe/user/1x1.png)