US Judge Approves Removal of FTX Turkish Units From Bankruptcy Case

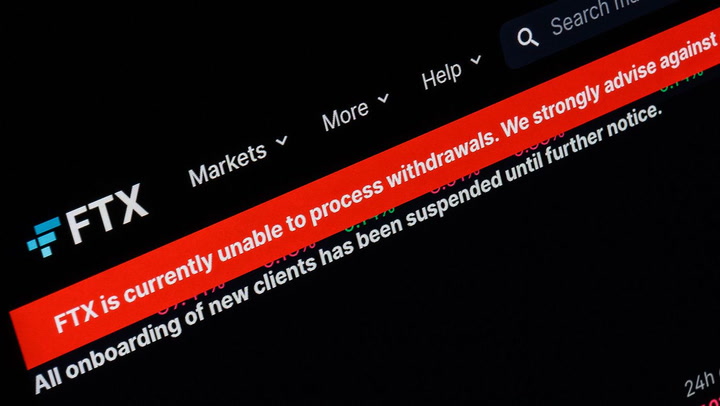

The crypto exchange had asked the court to greenlight the exclusion of the units after Turkish authorities ordered the seizure of most of its assets in the country.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/CLCXQPVPH5AA7KABZVJX7QXDTE.jpg)

FTX's Turkish units will be excluded from its U.S. bankruptcy proceedings after the failed crypto exchange said authorities in Turkey are unlikely to cooperate with U.S. courts.

Delaware-based Bankruptcy Court Judge John T. Dorsey signed an order approving the dismissal on Monday in response to a January request by FTX representatives.

Just days after FTX filed for bankruptcy in November, Turkish law enforcement announced the company's local activities were under investigation, and later ordered the seizure of a majority of FTX's assets in the country. FTX's new management in the U.S. argued it was unproductive to include FTX Turkey and SNG Investments – whose assets and activities are largely confined to Turkey – in the restructuring plans.

The court found the request is "in the best interests of" FTX and its estate. Parent company FTX Trading Ltd. owns 80% of FTX Turkey while SNG Investments is fully owned by FTX’s sister trading firm, Alameda Research.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/9c8b3491-ddb0-4e4a-8964-81cb59954944.png)