Voyager Digital's Creditors Push Back Against Plans to Provide Execs With Legal Immunity

Court filings revealed that Voyager executives have attempted to bake broad releases protecting themselves from future lawsuits into their sale agreement with FTX US.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/SXWBMJ6KAJFWVCPQVC4NZ5JYCU.jpg)

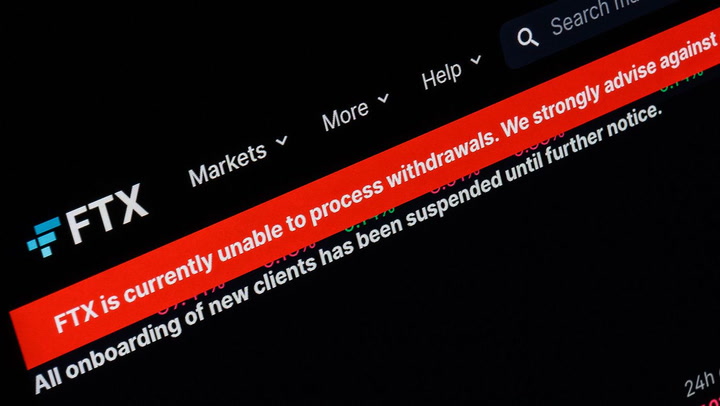

Bankrupt crypto lender Voyager Digital's plans to sell its assets to crypto exchange FTX US for $1.4 billion have so far gone relatively smoothly, but one major catch emerged on Wednesday – Voyager’s executives have included sweeping legal immunity for themselves in the proposed sale agreement.

In a partly redacted objection to Voyager’s proposed sale agreement, Voyager’s unsecured creditors committee (UCC) pushed back against the provision for “broad releases” that would shield the crypto lender’s directors and officers – the individuals “principally responsible for the debtors’ financial woes,” according to the filing – from future lawsuits.

In its current form, the sale agreement is contingent on the provision of legal immunity.

Attorneys for the UCC describe a “Hobson’s choice” for Voyager’s creditors: to either support the sale agreement as-is and have a chance at getting their money back faster while allowing Voyager’s executives to get off scot-free, or to fight the plan and risk the bankruptcy process “devolving into a morass of litigation, to the sole detriment of unsecured creditors, whose assets will continue to remain frozen for a far longer period of time.”

According to Wednesday’s filings, the UCC conducted an investigation into Voyager’s executives’ conduct to find out what the legal immunity would shield them from and called its findings “sobering.”

Details of the UCC’s findings are currently unavailable, but the attorneys argued that attempts to protect the executives from lawsuits were “particularly egregious” because of the potential for “colorable and valuable causes of action against these directors and officers.”

The UCC’s objection urges the court overseeing Voyager’s bankruptcy proceedings to reject the provision for legal immunity but proceed with the sale agreement.

Voyager filed for bankruptcy in July after the implosion of crypto hedge fund Three Arrows Capital in June. Voyager made a $670 million loan to Three Arrows early this year.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/572b85a4-8cec-4461-a07f-e8426649a469.png)