HSBC Starts Metaverse Fund for Private Banking Clients in Asia

The Metaverse Discretionary Strategy portfolio aims to capture opportunities arising from the next iteration of the internet, the bank said.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/MPQWNFWXAJFCDBX4H6MOK4WEL4.jpg)

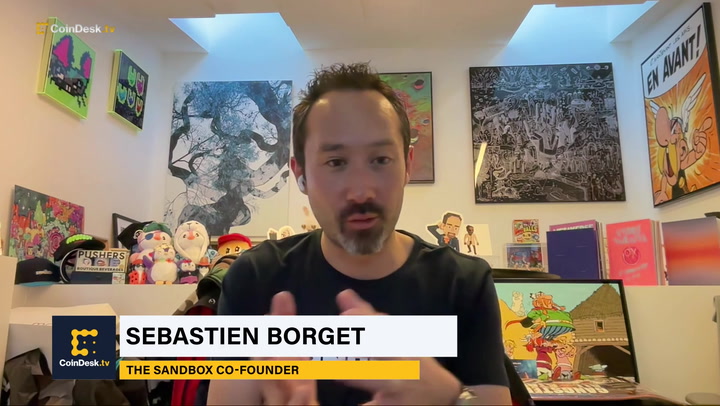

HSBC (HSBC), one of the world's largest banks, is starting a discretionary managed portfolio investing in the virtual world for private banking clients in Asia.

The strategy aims to capture growth opportunities arising globally from the development of the metaverse ecosystem over the next decade, the bank said in a statement, adding that the “metaverse is expected to become the next iteration of the internet.”

The metaverse is an immersive digital world created by the combination of virtual reality, augmented reality and the internet. In March, HSBC said it became the first global bank to enter The Sandbox metaverse, when it bought a plot of land to engage with sports, e-sports and gaming fans. The total addressable market for the metaverse economy could be as large as $13 trillion by 2030, Citi said in a report last week.

The portfolio will be actively managed, with a focus on five key areas: infrastructure, computing, virtualization, experience and discovery, and human interface, the bank said.

The strategy will be exclusive to HSBC’s high net worth and ultra-high net worth professional and accredited investor clients in Asia. It will be managed by HSBC Asset Management.

:format(jpg)/downloads.coindesk.com/arc/failsafe/user/1x1.png)