FTX CEO Says US Is Next Big Target Market

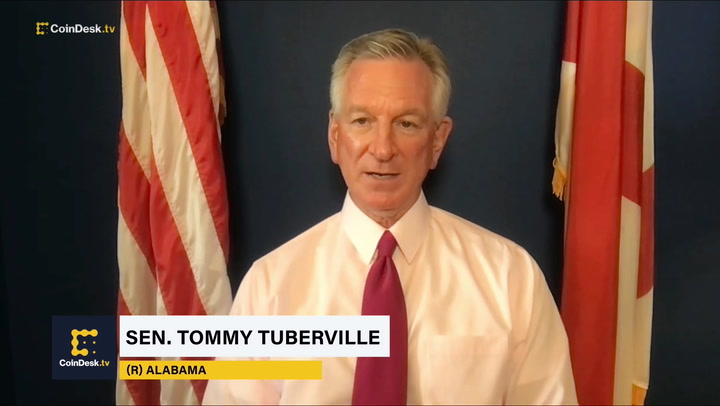

"When you look at FTX US, there's an enormous amount of potential growth in the states," Sam Bankman-Fried said Thursday on CoinDesk TV's "First Mover" program.

:format(jpg)/downloads.coindesk.com/arc/failsafe/placeholders/16x9.png)

Flush with $900 million of fresh capital, Hong Kong-based crypto derivatives exchange FTX has an eye on expanding business in its CEO's home country.

"When you look at FTX US, there's an enormous amount of potential growth in the states," CEO Sam Bankman-Fried said Thursday on CoinDesk TV's "First Mover" program.

"There isn't nearly as much business going on right now as you would expect given the size of the economy," the 29-year-old California-born entrepreneur went on. "A lot of that is regulatory. It's something that we're working on there."

FTX has been laying the groundwork to become a household name in the U.S. through high-profile, sports-related marketing deals with basketball, baseball and (American) football leagues and luminaries.

As it stands, FTX's global customer base is "everywhere ... all over the place," Bankman-Fried said. "There isn't any dominant jurisdiction," and no single jurisdiction makes up more than 10% of the company's revenue, he said.

While acknowledging that China's recent crypto crackdown has weighed significantly on the price of bitcoin and the asset class broadly, Bankman-Fried downplayed its direct impact on FTX's business.

"While it is a relevant jurisdiction, it's not an overwhelming one," he said of China. "While I think have a lot of Chinese users for a non-Chinese exchange, we don't nearly as many as Chinese-native ones do."

Asked how FTX would deploy the proceeds of the record-setting Series B funding round announced this week, the CEO said that acquisitions would likely be the main investment. In particular, FTX is interested in buying firms that would expand its set of licenses, user base and familiarity with assets such as fiat currency and stocks "that we don't have much expertise with."

:format(jpg)/downloads.coindesk.com/arc/failsafe/user/1x1.png)