Huobi Global Connects to European Banking System via UK’s BCB Group

The crypto exchange is partnering with BCB Group to get instant GBP and euro settlement for its customers.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2AVN5JPCZVDN3J6AAOY452BKH4.jpg)

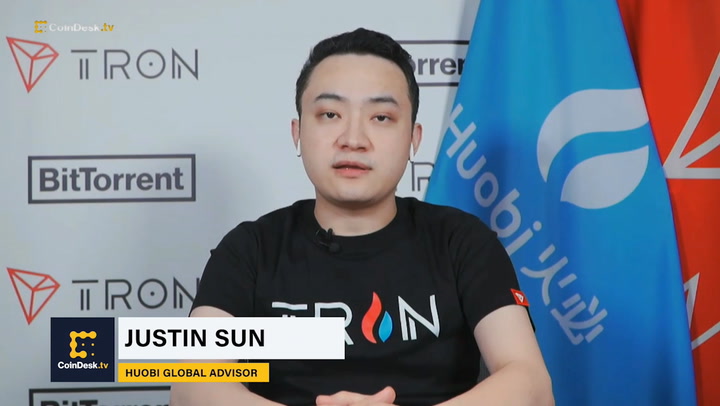

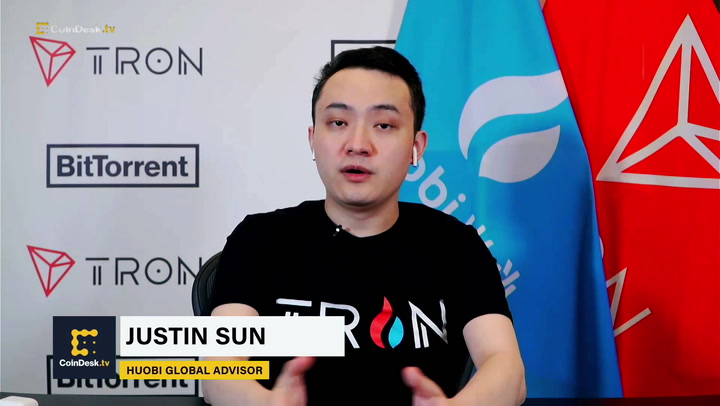

Regulated crypto payment services firm BCB Group has partnered with Huobi Global to help the Seychelles-based exchange giant connect its trading desks to the banking system in the U.K. and Europe.

Announced Tuesday, customers of Huobi’s over-the-counter (OTC) platform will be able to settle transactions instantly in euros and pounds (GBP) via BCB’s BLINC network.

Cryptocurrency exchanges have struggled in recent years to secure banking relationships and establish an interface with the fiat currency world, with some large exchanges having massive daily volume in closed systems of crypto-to-crypto trading. Prior to partnering with BCB, Huobi did not have a European fiat gateway, said Oliver von Landsberg-Sadie, founder and CEO of BCB Group.

“We’re here to provide that robust infrastructure so that these guys can just get on with trading and know that trades are happening in a way that’s properly monitored, that’s regulatory-friendly,” Landsberg-Sadie said in an interview.

The bar is high and Huobi had to jump through a few significant hoops. The whole process took some time to complete, he added.

“We understand the importance of both a compliant and streamlined service,” Ciara Sun, Huobi’s head of global business, said in a statement. “Partnering with BCB allows us to offer a European fiat on- and off-ramping service that we know is in line with the laws of that area, but it also allows our customers in Europe to experience a smooth and hassle-free user experience.”

BCB, which started out as an over-the-counter desk, partnered with U.K.-based Clearbank, as well as some other European banks, to facilitate crypto-to-fiat on/off ramps. The BLINC real-time settlement system, which is a bit like SWIFT for crypto in that users are legally identifiable entities, is supported by R3’s Corda platform and the Digital Asset Shared Ledger (DASL).

Huobi joins Bitstamp, the other large exchange taking advantage of BCB’s BLINC payment network. BCB also works with Coinbase and Kraken, but those exchanges are not part of BLINC.

Huobi is the latest large, reputable exchange that BCB has managed to bank, with a few more “kind of in-flight” to be announced soon, said BCB Group partner Ben Sebley.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/5ca74297-e3be-4402-a07e-b8aa3de111e4.png)