Huobi, Dragonfly, Coinbase Invest $500K in New DEX With Alternative Oracle Solutions

CoFix claims to have better token price feeds based on a pricing mechanism derived from a decentralized price oracle and the DEX’s patented risk assessment model.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FJLHJXBQBZGDHORVLBIMISR45Y.jpg)

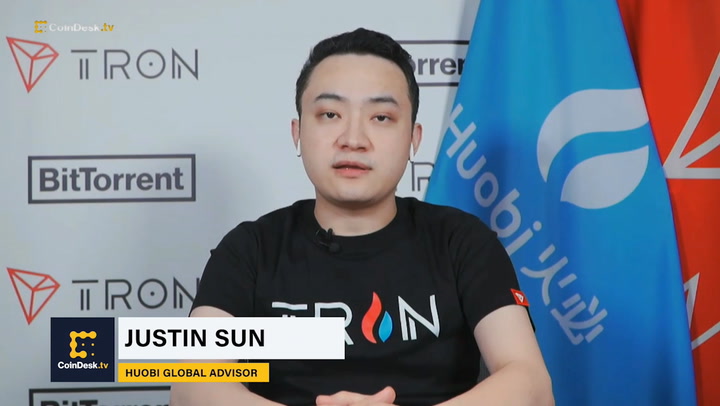

Decentralized exchange CoFiX, which aims to offer more accurate and less costly trading with a new oracle solution, has raised half a million dollars from several crypto investors including Huobi’s DeFi Labs, Dragonfly Capital and Coinbase Ventures.

Many existing decentralized finance (DeFi) platforms such as Uniswap and Compound use oracles that rely on external data from centralized exchanges and other DEXs to provide price feeds on-chain.

This process can create a deviation between oracle price and the actual market price, where arbitrage trading occurs during price discovery and liquidity pool rebalancing. Traders and market makers will bear the arbitrage cost.

However, CoFiX claims to have better token price feeds based on a pricing mechanism derived from a decentralized price oracle called NEST and the DEX’s risk-assessment model.

In NEST Protocol, miners receive NEST token rewards by paying commissions and providing price quotations, while verifiers profit from the difference between miners’ quotations and market price. Thus, CoFiX said, the protocol can have a set of financial parameters to verify prices and generate arbitrage-free price feeds.

CoFiX will also factor in other price risks such as time via a mathematical model. In particular, it receives a market price "P" from NEST and factors a risk coefficient "K" into P to account for time delay and volatility. The platform then produces a new reference price that traders and market makers refer to when making transactions.

“CoFiX is trailblazing a new path in DeFi with an innovative solution that can truly attract institutional traders and market makers to the space,” said Chief Investment Officer Sharlyn Wu. “It leads DeFi into a new chapter of ‘Computable Finance.’”

Founded in March, the development team behind CoFiX include developers from DeFi project AlphaWallet and blockchain security team SECBIT, according to AlphaWallet founder Victor Zhang.

The new funding will be used to cover the costs of protocol auditing and early development.

CoFiX's official launch is slated for later this month and there will also be a liquidity mining program to distribute 90% of its $COFI tokens to users, according to the firm.

:format(jpg)/downloads.coindesk.com/arc/failsafe/user/1x1.png)