Curve Finance Founder Deposits $24M CRV into Aave to Safeguard $65M Stablecoin Loan

CRV is trading 2.1% lower over the past 24-hours following a sharp drop on Saturday.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJCHEKUJZVANVGIFOQLOZJINSU.png)

Takeaways

• Over 291 million CRV tokens have been deposited to Aave, equating to 34% of circulating supply.

• CRV token is down by 2.1% in 24-hours following a sudden 17% drop on Saturday.

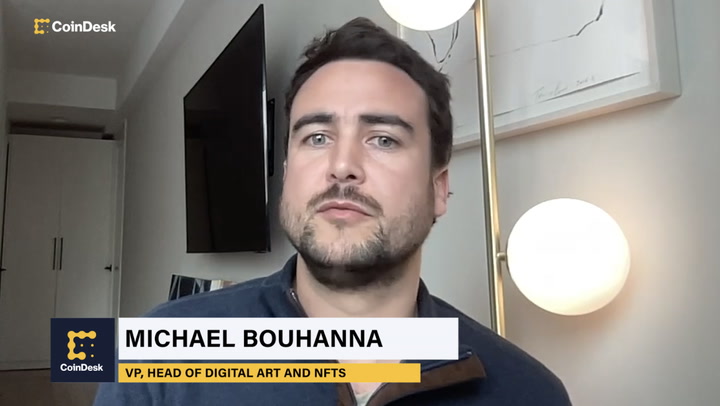

Curve Finance founder Michael Egorov has deposited $24 million worth of Curve DAO (CRV) tokens to decentralized lending platform Aave to mitigate the liquidation risk of a $65 million stablecoin loan.

Egorov began borrowing stablecoins on Aave in April, with $37 million worth of tether (USDT) being sent to crypto exchange Bitfinex whilst $51 million in USDC was sent to prominent market maker Wintermute, according to blockchain sleuth Lookonchain.

The wallet belonging to Egorov has supplied a total of $188 million in collateral on Aave, with $64.2 million in USDT being borrowed in an open position, according to Debank.

The open position currently has a health rate of 1.68, the collateral will be automatically liquidated if it drops below 1.00.

CRV is currently trading at $0.65 having dropped by 2.1% in the past 24-hours, it slumped by more than 17% in a sudden move in the early hours of Saturday morning.

If the price of CRV is to continue to slide over the coming months, the value of collateral and thus the health rate will also suffer. CRV is 90% lower than its 2022 all-time high of $6.50.

In January, Aave cleared bad debt positions that occurred after the Mango Markets exploit worth 2.7 million CRV.

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)