Bitpanda Partners With Coinbase to Help Europe’s Banks Offer Crypto to Customers

Coinbase will use Bitpanda Technology Solutions, a business-to-business infrastructure layer provider, to connect directly into banks and fintechs.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JOVAV5PWJNE73EWLILCMBK225M.jpg)

Austrian-based crypto exchange and trading platform Bitpanda is teaming with Coinbase (COIN) to connect the U.S.-listed exchange giant with banks in Europe who are looking to offer digital assets to their customers.

The just-announced partnership allows Coinbase to use Bitpanda Technology Solutions – a business-to-business infrastructure layer provider – to connect directly into banks and fintechs.

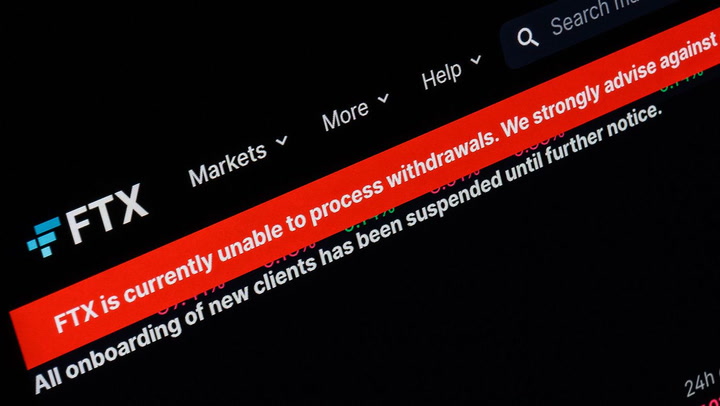

Despite the bearish crypto winter and the damage done to the reputation of the asset class from last year’s blowups and failures, banks want to be able to offer crypto to customers, according to BitPanda COO Lukas Enzersdorfer-Konrad. This is especially true in Europe now that the Markets in Crypto-Assets (MiCA) regulatory framework has been adopted, he added.

“Coinbase has a liquidity venue with their exchange and they have the custody setup,” Enzersdorfer-Konrad said in an interview with CoinDesk. “But they don’t have the whole infrastructure middle layer that a partner can integrate and offer crypto traded and bought on Coinbase exchange and stored on Coinbase Custody to their end customers.”

Bitpanda’s crypto connectivity is already in place with a number of banks, neo-banks and fintech platforms such as Austrian traditional lender Raiffeisenlandesbank, European mobile bank N26, French money app Lydia, U.K. fintech Plum and the Italian mobile bank Hype.

“Banks can see the data on their payment transactions and how much of their customers’ funds have been flowing out to crypto companies,” Enzersdorfer-Konrad said. “They understand how much business they are missing out on, and also how much more of their customer base would do that business, if they had enough trust in the process.”

"[Coinbase is] delighted to partner with Bitpanda to jointly service institutions looking to bring the market and their customers compliant, robust crypto services," said Guillaume Chatain, Coinbase’s head of Institutional Sales for EMEA & APAC regions, in a statement.

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/5ca74297-e3be-4402-a07e-b8aa3de111e4.png)