FTX Can Start Mediation, File Counterclaims in BlockFi Bankruptcy Case, Judge Rules

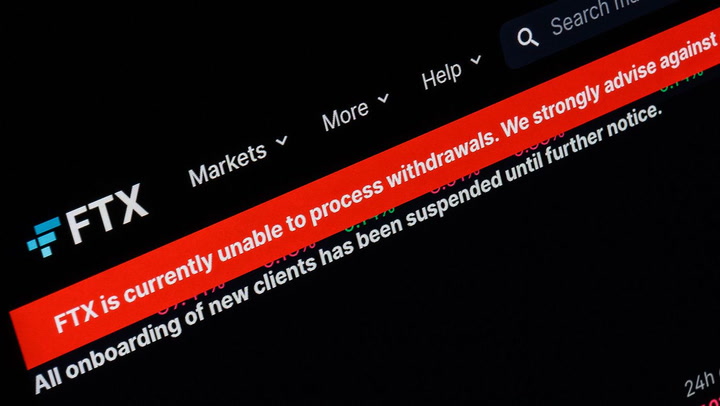

BlockFi filed for bankruptcy in late November last year, in part because of the ripple effects of the sudden collapse of FTX, which triggered an automatic stay that halted proceedings between the two.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/BXTU66VXJJD3TBG64QJME5XXRI.jpg)

A U.S. judge ordered the end of an automatic stay on proceedings between bankrupt crypto firms FTX and BlockFi, meaning the two can start negotiating a claims settlement.

BlockFi, a lender, filed for bankruptcy in late November last year, in part because of the ripple effects of the sudden collapse of FTX earlier that month. That triggered the automatic stay, halting proceedings between the two. BlockFi had an estimated $355 million frozen on the crypto exchange's platform and was owed a further $671 million by FTX's sister company, Alameda Research.

The stay has been modified to allow FTX debtors to make "arguments, defenses, counterclaims, setoffs, or otherwise ... with respect to the BlockFi claims in the FTX bankruptcy proceeding," according to a Nov. 13 court order by U.S. bankruptcy judge Michael Kaplan.

Sam Bankman-Fried, the founder of the now bankrupt FTX, was found guilty on all seven counts of defrauding his customers and lenders at the start of this month following a five-week trial.

BlockFi CEO Zac Prince testified against Bankman-Fried as part of the trial, detailing how the firm was forced to declare bankruptcy when it did because of its involvement with FTX and Alameda, having lost "a little over a billion dollars."

In late September, BlockFi's creditors approved a bankruptcy restructuring plan that would, in theory, allow it to recover the assets lost to FTX as well as those it lost when crypto hedge fund Three Arrows Capital collapsed in the summer of 2022.

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/008ae87f-5c6e-412b-816b-ded600ac5054.png)