Zipmex Crypto Exchange Gets Over 3 Months of Creditor Protection in Singapore: Report

The city-state's High Court granted Zipmex protection from creditors until Dec. 2 to give the exchange time come up with a funding plan.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4VEAPUGMQJBSJAMAAD7UADPDTQ.jpg)

Singapore's High Court granted beleaguered crypto exchange Zipmex more than three months of creditor protection so it can devise a funding plan, Bloomberg News reported on Monday.

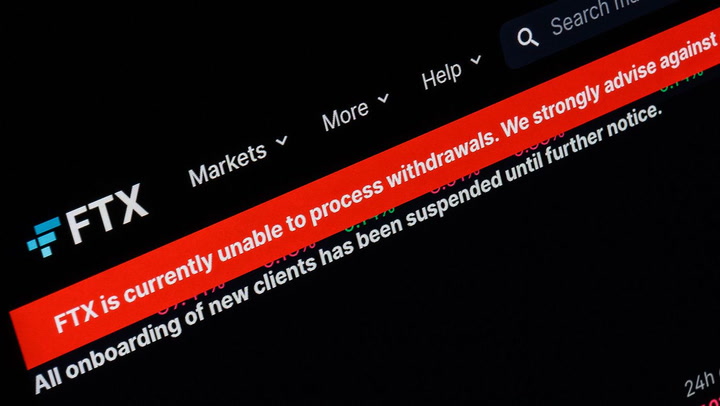

The company, which filed for protection from creditors and suspended withdrawals in July, will be protected against potential creditor lawsuits until Dec. 2, the report says.

At that time, Zipmex's solicitors, Morgan Lewis Stamford, applied for six months of protection under Singapore’s insolvency law across the exchange's five entities covering Singapore, Thailand, Indonesia and Australia.

The five entities are Zipmex Asia Pte. Ltd., Zipmex Pte. Ltd., Zipmex Company Ltd. (incorporated in Thailand), PT Zipmex Exchange Indonesia and Zipmex Australia Pty. Ltd.

In an announcement dated Aug. 2, Zipmex said it is "exploring multiple avenues" to secure funding. It said it is expediting due diligence after signing a memorandum of understanding (MOU) with two investors.

Zipmex is one of several crypto companies that succumbed to market pressures over the past two months, with the likes of Celsius Network and Voyager Digital filing for bankruptcy while Singapore-based hedge fund Three Arrows Capital imploded.

Zipmex loaned $48 million to Babel Finance and $5 million to Celsius, both of which failed to repay their loans.

Zipmex did not immediately respond to CoinDesk's request for comment.

UPDATE (Aug. 16, 15:18): Removes reference to bankruptcy from subheading.

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)